Visius

Comply with anti-money laundering regulations and effectively manage KYC process

Efficiency

70%

time saved in reconstructing the ownership chain

Accuracy

-80%

false positives in alerts

Automation

-80%

manual tasks in anti-money laundering processes

The solution to automate the Know Your Customer process

Visius simplifies the KYC process required for all entities subject to anti-money laundering regulations, reducing operational time and costs.

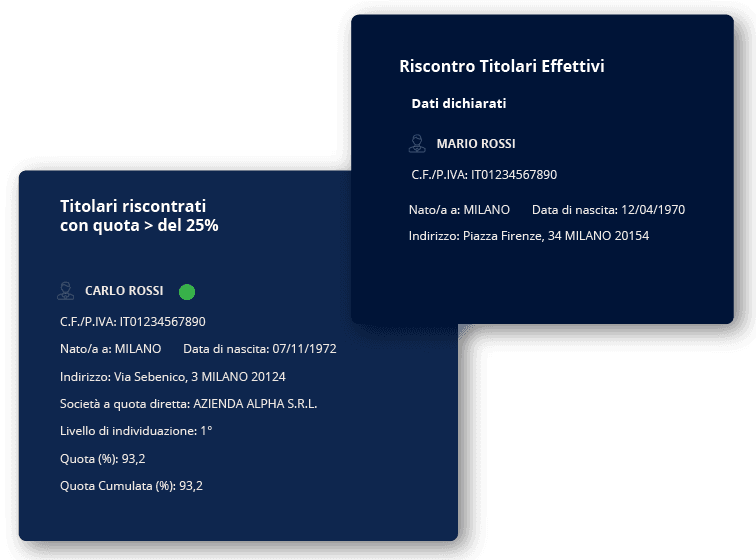

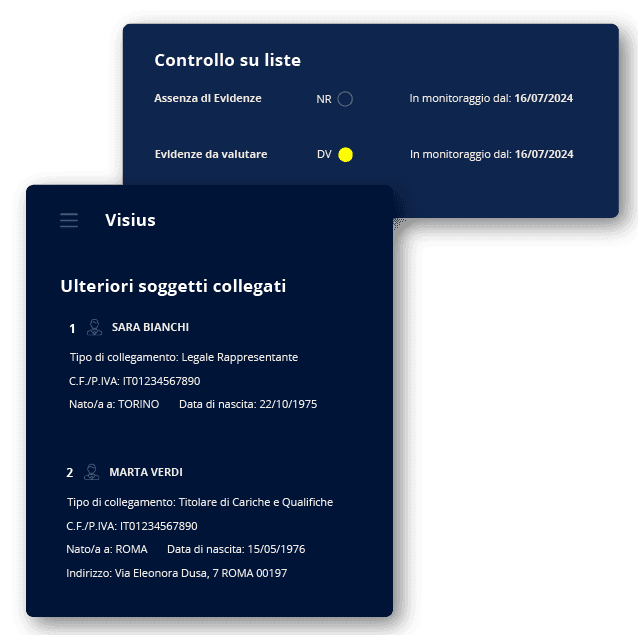

The solution compares the data declared by a subject with reliable and independent sources, assigns an adequately verified risk profile to the position, creates a summary dossier with all the gathered information, and manages continuous monitoring.

More efficient checks on declared information and AML lists

Visius analyses the personal information provided by the client, makes checks, and develops a dossier that assigns a risk profile to each entity. The monitoring service let you immediately view any changes in risk.

A single entry point for money laundering risk assessment

With Visius, you have a single entry-point to easily and quickly make checks on money laundering risk evaluation

- Financial statements reclassified according to a standardized model that compares economic and financial results regardless of the type of document or accounting principles used

- Reports useful for analyzing a company's performance relative to its sector

- A predictive model that considers the sector and geographic location of an entity to assign a probability of default and determine a risk category

Features

Cerved, ION Analytics, PEP, PIL, Crime and Adverse Media, etc.

Q&A

How can I obtain targeted evaluations for different types of entities?

Visius generates specific dossiers for individuals and companies, which let you easily and intuitively view the results from comparing the customer’s declared data with the information in the Cerved database and AML lists. L.

How can I stay updated on a subject's risk profile?

The monitoring service alerts you to any changes even in a subject’s risk profile, enabling continuous and proactive checks.

Choose Visius and perform anti-money laundering checks with a single tool!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015