Risk Simulation

Optimise your credit strategy with prospective analysis of portfolio risk

Efficiency

< 60 min

to do a complete stress test on 100% of the credit portfolio

Compliance

100%

monitoring of credit portfolio based on regulatory credit risk measures

The solution for the analysis of portfolio prospective risk under adverse conditions

Risk Simulation is an advanced platform for doing stress analysis on credit portfolio and predicting the effect on capital and profitability.

You can do simulations based on macroeconomic scenarios with differentiated levels of severity, analyse the effect of the different scenarios on credit risk parameters (e.g. PD, LGD), and regulatory measures (e.g. RWA, ECL), while also meeting the governance and monitoring requirements provided for by the EBA-LOM guidelines.

Several features to optimise monitoring strategies

The platform allows you to:

- Do basic and dynamic simulations guided by standard or customized assumptions

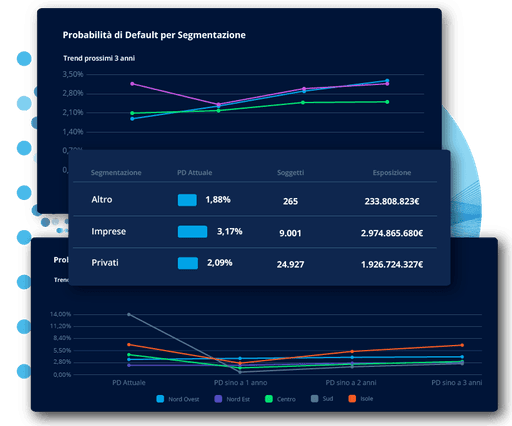

- Consult interactive dashboards with insights that help you evaluate the effect of scenarios on capital measures and credit risk

- Compare the results of the different simulations, archive them, and create summary reports

Q&A

What is the difference between basic and dynamic simulations?

Basic simulations are based on standard assumptions, with non-configurable parameters, using macroeconomic scenarios with preset weight and Cerved econometric models to generate Forward-Looking, PD and LGD curves. Dynamic simulations, on the other hand, are customized "what-if" assumptions, which can set up one or more parameters simultaneously.

What data can be displayed with the dashboards?

You can display the expected trend on regulatory outputs (RWA, ECL) and risk parameters (PD, LGD), compare the simulated values with the current/threshold values defined by the bank, and analyse the different results got through past and current simulations.

For each risk index, it is also possible to have an overview and create in-depth analyses divided by subject type, geographical area, rating, staging, technical form, etc.

Analyse risk from a forward-looking perspective with Risk Simulation.

© 2026 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015