Real Estate Appraisals

Determine and monitor the value of real estate

Coverage

100%

national coverage thanks to our extensive network of appraisers

Timeliness

<10

average delivery time for appraisals

Credibility

25%

of mortgages issued annually in Italy are accompanied by a Cerved appraisal

A diversified range of real estate appraisals

Our appraisal offerings provide different levels of detail to meet the needs of evaluating various types of properties.

Our appraisals meet international valuation standards, are recognized by certified bodies, and are based on the monitoring of the real estate market throughout the national territory. Cerved ranks among the top 3 providers for appraisals during the issuance phase.

Professionalism at your service

A network of over 200 specialists works exclusively for Cerved nationwide, distinguished by their expertise, professionalism, and ability to handle the complexities of valuing extensive assets.

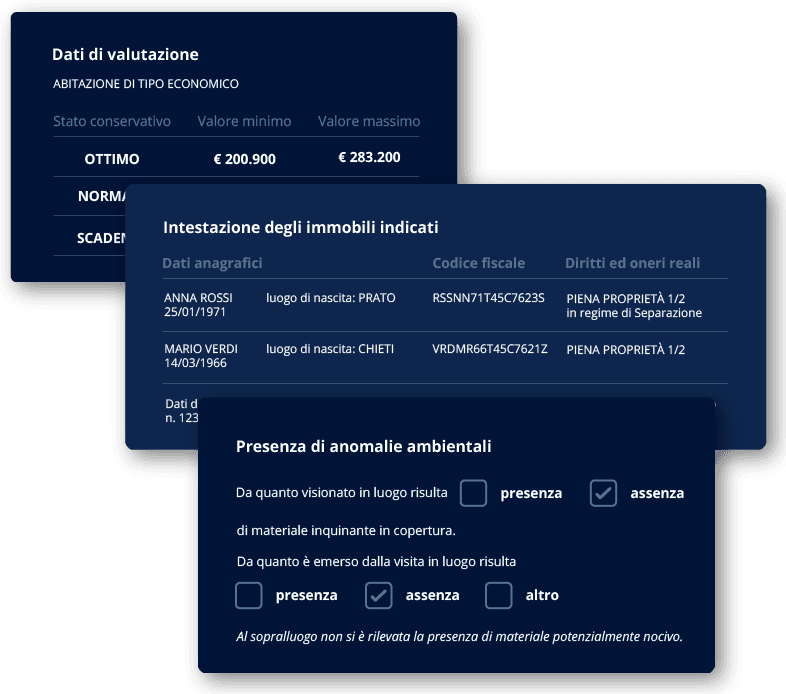

Land registry and mortgage checks to analyse and monitor real estate assets

We offer a modular range of reports and land registry/mortgage checks useful during the assessment, issuance, credit recovery, and monitoring of guarantees. The documents are produced by integrating numerous information sources (Conservatory, Land Registry, Business Register, official reports on seismic and hydrogeological risks, real estate market observatories, etc.) and include insights on companies as well as real estate market trends.

Features

Q&A

Which types of appraisals do you offer?

The Full appraisal verifies urban planning and cadastral compliance and determines the real estate value through internal and external inspections, while the Drive-by appraisal involves an external inspection to collect and analyse various elements useful for valuation. Desktop appraisals, which do not require an inspection, are also available. The appraisal can be supplemented with Due Diligence to perform technical/environmental checks and retrieve necessary documentation.

Beyond market value, what other value bases or analyses are included in the appraisals?

In line with ECB and EBA LOM guidelines, the documents include the calculation of the property’s future value (Predictive Market Value), the most likely forced sale value in case of judicial auction proceedings (Judicial Market Value), and the calculation of the property’s value net of the expected annual loss due physical risk.

When is it advisable to request a land registry/mortgage check?

It is the ideal document to gain in-depth knowledge of a subject’s assets based on land registry and conservatory data, without the need for an appraiser's evaluation. The land registry/mortgage check is recommended for assessing significant disbursements or during recovery processes.

Get a complete picture of real estate assets and make the right decisions quickly!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015