Subsidized Finance - Public Guarantees

Manage subsidized credit with a range of specific services

Efficiency

+40%

productivity in managing files

Speed

+ 50%

+50% faster loan disbursement

A solution aimed at supporting access to financing

Take advantage of a range of end-to-end services for the management of public guarantees accessible to financial intermediaries: Fondo Centrale di Garanzia (the Central Guarantee Fund), ISMEA, and SACE. Our consultants are by your side throughout the entire process, helping you through the specific Cerved platform and giving you training and updates on regulations.

A structured workflow to manage subsidized credit

This solution allows you to manage to get subsidized financing for your clients in all phases:

- Preliminary feasibility assessment, by identifying the fund creditworthiness class and calculating the state aid eligibility

- Admission to the Guarantee Fund , by checking documents, eligibility requirements, and uploading the application through the portal

- Post-disbursement and monitoring, by managing deadlines and continuously monitoring significant changes

- Guarantee payment request, including monitoring of the claim process managed by the Guarantees Fund

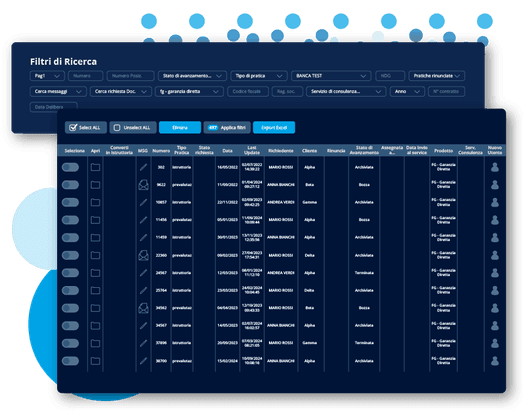

Manage loan applications with specific tools

Complete the management of public guarantees with specific tools to enhance efficiency and respect regulations:

- DocGest facilitates document exchange with Cerved and allows you to manage and track the entire process of Guarantees Fund applications

- Dimensiona reconstructs a company’s size and connections in real time, in compliance with the regulations required for accessing subsidies

Q&A

What is included in the post-disbursement and monitoring phase?

We take care of managing deadlines, monitoring relevant events, processing additional documents, reporting risk events, and providing support in case of inspection activities by the Guarantees Fund.

How important is the concept of "sizing" in Subsidized Finance?

European regulations and the Ministerial Decree of 18.04.2005 establish that verifying company size is mandatory to determine the eligibility and intensity of subsides. This activity is time-consuming and complex, requiring verification of the several connections among companies.

How is the aid intensity of financial incentives calculated?

The verification is done according to the relevant regulations and, when necessary, also in the context of the concept of a Single Undertaking.

Discover the ideal subsidies for your clients.

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015