FinBox

Digitize the credit lending process and enhance credit scoring

Efficiency

<20

hours to complete the on boarding and credit origination process

User experience

<60

minutes for customers to complete the online application

Automation

-90%

reduction in the time spent on manual reviews of new applications

The Digital Lending solution that supports all parties involved in the credit lending process

FinBox is a modular and configurable platform designed to meet your needs, helping you handle the end-to-end origination process.

Enhance your customer experience

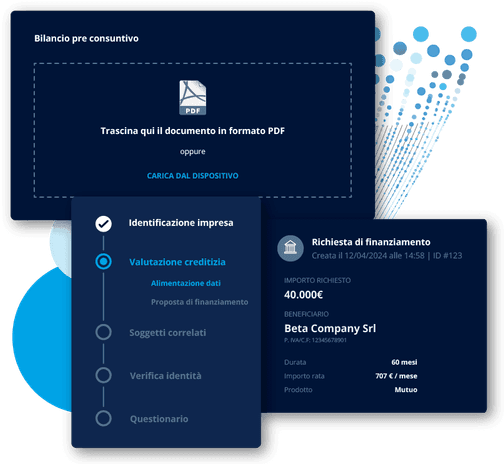

Thanks to automated and codified processes, FinBox allows you to enhance the customer experience, improve credit assessment, and speed up decision-making processes, drastically reducing the time-to-yes.

A comprehensive platform to meet all your needs

The platform is comprised of 8 modules, allowing you to customize your workflow, from digital origination and digital assessment to signature verification, key information extraction from documents, and support for the end customer’s "subsidy request" to the Guarantee Fund.

Caratteristiche

Q&A

How can I monitor the origination process?

The FinBox Analytics dashboard allows you to monitor the digital funnel and manage the end-to-end process.

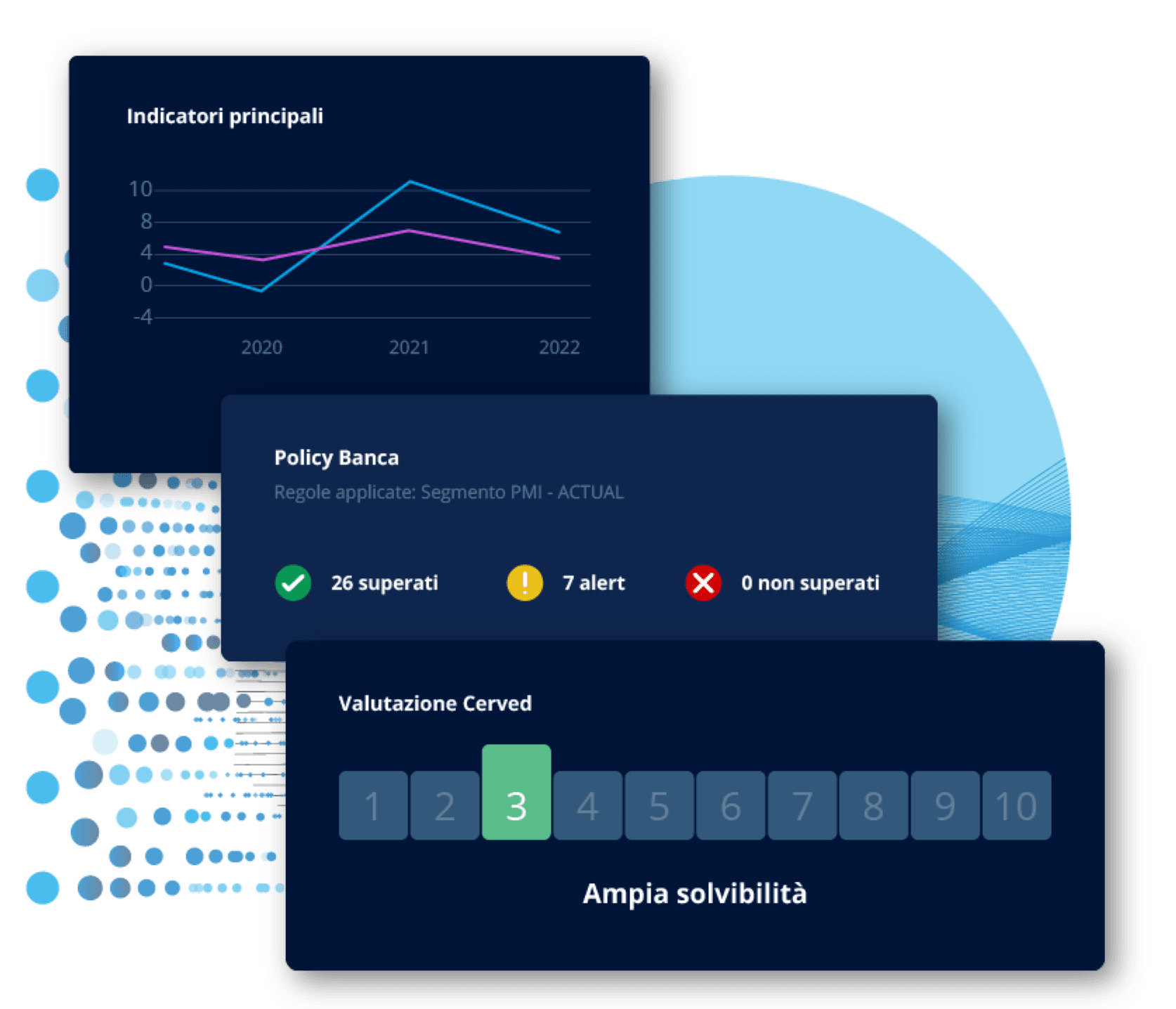

Is it possible to speed up business evaluations without compromising the quality of the analysis?

The Pre-screening and Evaluation modules allow you to run simulations, analyse companies, and assess sustainability scenarios through projected financial statements.

Is there a way to simplify the process of applying for financial subsidies?

Guided and automated completion paths are just what you need! Reduce errors and the time it takes to complete questions, facilitating access to guarantee funds.

Increase the efficiency of your decision-making processes with FinBox!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015