Credit Board

Manage your company’s credit policy effectively

More liquidity

-20%

DSO

Efficiency

-50%

time spent on collection activities

Flexibility

100%

adaptable to every company’s credit policy

Efficiency and automation in credit management

Credit Board makes the credit policy operative and widespread in your company. From evaluations and analysis on risk prevention to credit monitoring and collection, by the platform you can check the risk end-to-end, raising productivity and the involvement of the different corporate roles. Choose the best workflow for your company and let us guide you in monitoring activities and managing the portfolio.

Improve credit management in each crucial moment

With Credit Board you can analyze, rationalize and improve credit risk prevention thanks to customizable workflows, detailed overviews of your customers, a large range of reports, assessment indexes and Cerved data. Moreover, multi-company and multi-country management makes it an ideal tool for companies operating internationally, ensuring a complete coverage and a centralized control on credit management activities.

Features

Q&A

How can Credit Board disseminate the credit policy in a company?

Daily alerts about advised actions on customers are sent to representatives so that all corporate charges interested in credit prevention and collection are involved.

How does Credit Board help reduce my company’s DSO?

Through continuous credit monitoring, the system automates payment reminders, speeds up collection times, and minimizes payment delays from your customer portfolio.

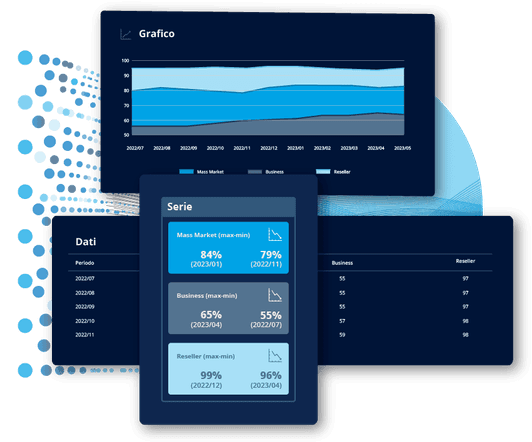

How can I get a summary and detailed view of data gathered from different sources?

The integration of Cerved, client and outsourcer management systems, together with dashboards customizable with KPI of interest, gives you a total and detailed view on available data.

Is Credit Board suitable to small companies?

If your firm is small, Credit Board suits you! Thanks to a simplified and standardized set-up process of credit policy, you get an accessible solution to improve processes you are interested in, in line with your company’s needs

Make portfolio management more efficient with Credit Board!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015