Credi

Analyse, manage, and mitigate the risks associated with your real estate collateral portfolio

Speed

<60

minutes to analyse a real estate portfolio

Efficiency

90%

reduction in costs compared to desktop valuation monitoring

The advanced diagnostic solution for real estate portfolio evaluation

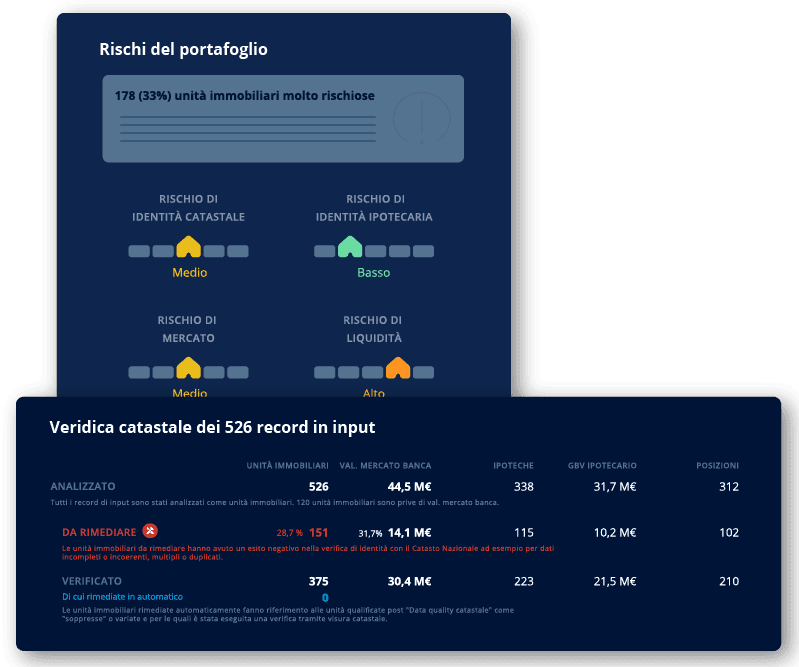

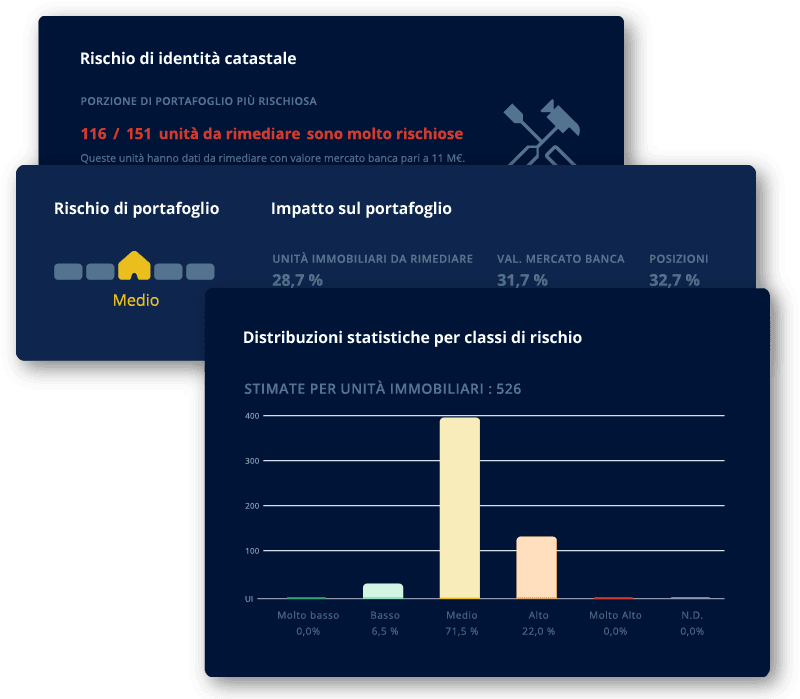

CREDI offers automatic data quality and data remediation for your portfolio, enriching it with Cerved data and enabling risk analysis with corresponding mitigation solutions.

The solution also ensures compliance with regulations regarding the analysis and prevention of risks associated with real estate assets. CREDI assigns a digital identity to each property, generating a periodic summary report and a detailed data sheet for each asset.

Property analysis and insights

CREDI generates a report for each real estate unit, providing a comprehensive overview of data quality and the risks associated with the properties. The analysis highlights the impact of each risk, identifies properties with the highest risks, and proposes further investigation and mitigation solutions.

The report is an essential tool for transparent and efficient real estate portfolio management, offering valuable support for making accurate and timely decisions.

Features

Q&A

What is meant by “digital identity of properties”?

Each property is assigned a unique and distinctive ID that allows for continuous monitoring and updating of information, ensuring accurate data and more advanced algorithms.

What are the main benefits of the solution?

Access to structured and updated data, precise and monitored analysis of real estate portfolio risks, and more efficient management of the assets that comprise it.

How is real estate data updated?

CREDI performs massive verification of the real estate collateral portfolio through official sources and instantly enriches data with Cerved proprietary databases and records. Additionally, the system automatically updates any modified units, ensuring the data is always current and reliable.

Prevent real estate risks and comply with regulations, with CREDI!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015