Cerved Credit Suite

Obtain strategic information and evaluate the creditworthiness of your business partners

The platform that supports you in risk management and decision making

Cerved Credit Suite helps you find out the reliability, the relationships and the financial situation of a customer, prospect or supplier to immediately intercept critical situations and identify growth opportunity to improve your business in Italy and abroad

This platform offers incremental contents to analyse creditworthiness in every aspect: credit risk, fraud, sustainability, analysis of the connections among subjects, companies’ payment behavior

Tailor-made contents, analysis and support

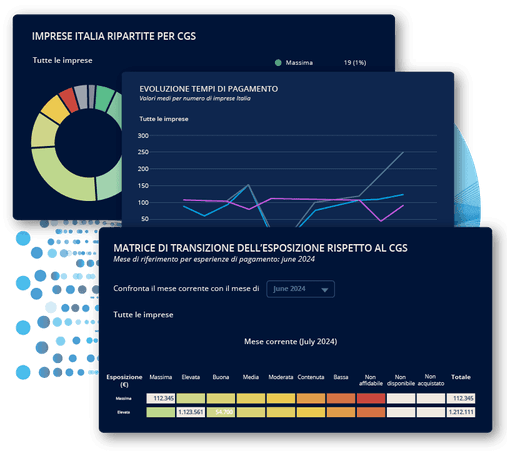

Documents with different levels of in-depth analysis can satisfy your specific needs, while preset graphs and tools allow to segment your customer portfolio to create tailor-made views.

Cerved Credit Suite sustains the whole credit life cycle and allows you to ask for our support to activate the credit collection process, manage and track the collection practices in the wider portfolio view.

Q&A

Which are the main available evaluations in Cerved Credit Suite?

- Credit risk to analyse the economic and financial situation and the current and future creditworthiness of a firm and its sector

- Fraud risk to identify critical situations and consult large-scale areas of investigation

- Sustainability to evaluate sustainability in the three ESG aspects and compare a company assessment within its industry

- Connections among subjects to identify, display and delve into relations among different entities and get strategic information

Which analysis tools do I have?

There are many, let us recall the main! Distribution graphs show how your portfolio companies are distributed in relation to the assessments, transition matrices show the variation month to month of the number of companies through different classes and evaluation types (show the variation month by month of the exposure and the number of companies among different classes and evaluation types); trend analysis of scores (accounting data and payment behaviour) allow you to examine the evolution of your portfolio.

Can I do customized analysis?

Of course! You can enrich Cerved Credit Suite with your own accounting data to calculate credit indexes, have distribution charts and transition matrices based on exposure values as well as our evaluations and obtain trend analysis including accounting data and payment experiences

Make the best decisions and keep your credit risk under control with Cerved Credit Suite!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015