CeBi Suite

Manage business financial information efficiently and in an integrated way

Speed

< 1

Less than 1 minute to search, retrieve, and process financial statements

Integration

100%

100% integrated into banking systems

An advanced tool for more accurate and informed decisions

CeBi Suite is the all-in-one solution that enables you to acquire, manage, and analyse all types of financial statements for any business. It ensures continuous methodological and regulatory oversight based on a standard widely adopted in the banking sector.

A platform, a world of information

CeBi Suite provides comprehensive insights into a company's solvency ratios, financial sustainability, and risk margins in both the short and medium term. It applies differentiated analytical frameworks depending on the type of business and financial statements, delivering a wide array of reports that offer a comprehensive and detailed view of a company’s economic and financial performance.

Managing information in an integrated way has never been easier

The platform provides a clear snapshot of a company's health, through a variety of content and features:

- Reclassified financial statements based on a standard model that compares economic and financial results, regardless of the document type or accounting standards used

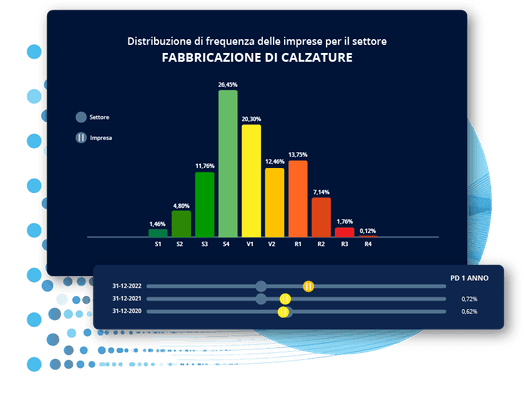

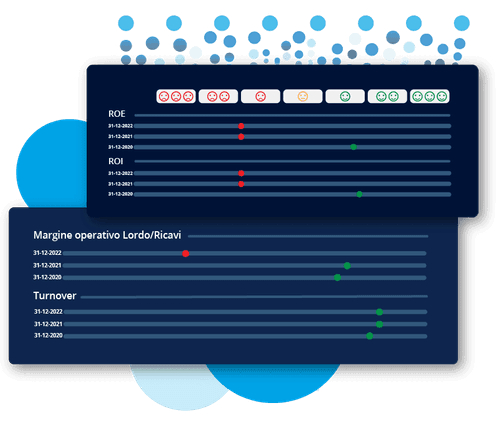

- Reports that help analyse a company's performance against industry benchmarks.

- A predictive model that evaluate the company’s sector and geographical location to assign a probability of default and a risk category.

Features

Q&A

What types of financial statements does the platform manage?

CeBi Suite manages official, interim, or draft financial statements prepared according to national accounting standards (Civil Code), IAS/IFRS, financial schemes, tax models, third sector entities, public administration, and foreign financial statements. Financial statements are reclassified using advanced and flexible schemes, offering a variety of layouts and indicators for a full financial analysis.

What reports are available in CeBi Suite?

Available reports include the CeBi analysis framework, economic-financial score, sector positioning indicators, expert analysis, sector comparison, and MCC score for the Guarantee Fund.

How can I take advantage of the risk profile score for a company?

The platform automatically calculates a company’s risk profile score based on the latest financial data and provides targeted assessments on specific areas such as profitability and liquidity.

Analyze economic and financial information quickly and efficiently with CeBi Suite!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015